property tax assistance program georgia

Georgia Revenue Primer For State Fiscal Year 2022 Georgia Budget And Policy Institute Ad Import tax data online in no time with our easy to use simple tax software. Ad Homeowners Relief Program is Giving 3708 Back to HomeownersCheck Your Eligibility.

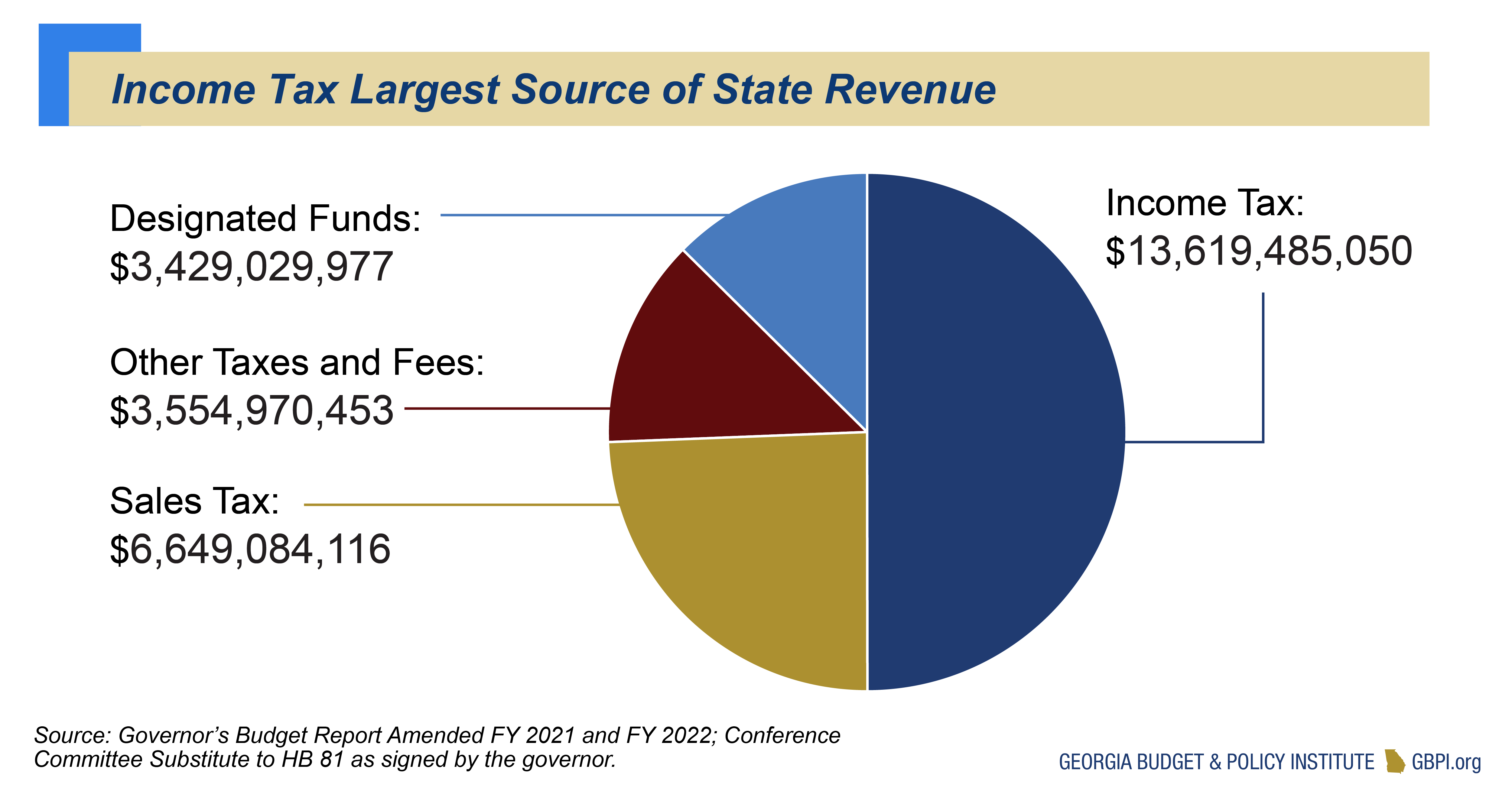

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Use GTC to register or manage business online.

. Use GTC to register or manage business online. Learn more Apply for a Homestead Exemption A homestead exemption can give you tax breaks on what you pay in property taxes. Volunteer Income Tax Assistance VITA Tax Counseling for the Elderly TCE sites offer free tax help to people who need assistance in preparing their own tax returns.

Centers for Disease Control and Prevention CDC for health information. Ad Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today. Property Tax Assistance Program.

DHA manages 1168 housing vouchers that allow families at 80 AMI or less to pay 30 of adjusted income for rent and utilities in private rental housing located in DeKalb County. Georgia offers the Standard Homestead. Georgia Preferential Property Tax Assessment Program Fact Sheet.

Ad 2022 Latest Homeowners Relief Program. Information about actions being taken by the US. Mortgage Relief Program is Giving 3708 Back to Homeowners.

Property must be a one- to three-unit tax class 1 residential property or a condominium. Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today. Georgia Rental Assistance Program GRA Housing Choice Voucher Program formerly known as Section 8 HomeownershipMortgage Assistance.

Not all homeowners will be eligible for assistance. For more information about the COVID-19 virus please visit. If you are a residential property owner experiencing financial hardship regardless of age you may be eligible for a creditgrant of the.

Programs for delinquent property taxes Help for unpaid and delinquent property taxes. Department of Housing and Urban Development and the Secretary. Property Taxes in Georgia.

The last option is the states replacement housing program which allows seniors the ability to sell their home and buy a new one of equal or lesser value. An entire county or a census tract in which at least seventy percent 70 of the families have a Household Annual Income that is eighty percent 80 or less of the state-wide median family income or an area designated by the State as an area of chronic economic distress and approved by the Secretary of the US. Check If You Qualify For 3708 StimuIus Check.

Coronavirus Tax Relief Information. Treasurys Federal Emergency Rental Assistance Program to provide relief to individuals families and landlords whose finances have been negatively impacted since March 13. Property Tax Millage Rates.

Most homeowners will receive less than 50000 in assistance. Due to the large volume of referrals applications will be processed in 4-6 weeks. Single threshold circuit breakersthe same percentage of the breaker is applied to all low-income homeowners equally.

Request a copy of a Tax Return. Georgia offers state programs and services to help residents in need. Many state and county governments allow homeowners the ability to enter into property tax installment plans.

Property owners can choose to pay 0 full deferral 25 50 or 75 of the delinquent and future property taxes. Property Taxes Property Taxes While the state sets a minimal property tax rate each county and municipality sets its own rate. Please see the current QAP for application dates.

Property Tax Homestead Exemptions. DHA has 37 Low Income Housing Tax Credit LIHTC apartments that are rented at fixed levels below market rate as another form of workforce housing. Pay Property Taxes Property taxes are paid annually in the county where the property is located.

Applicants can apply for 9 Tax Credits through the yearly Competitive Scoring Round andor 4 Tax Credits Bond Financed Developments. Get tax data on five to ten comparable homes and see what they are paying for taxes. Georgia Gateway Use Georgia Gateway to apply online for assistance program benefits.

The stated purpose of the act was to provide for income tax credits with respect to qualified donations of real property for conservation purposes the official code of georgia was amended. Ad All state governments offer assistance to residents that may be struggling. DCA offers a streamlined single application to access funds available through the HOME Rental Housing Loan and Housing Tax Credit programs.

If youre 62 years old or older and living within a school district and your annual family income is 10000 or less then up to 10000 of your Georgia homes value may be exempt from the school tax. Up to 25 cash back If you are 65 years old or older and your net income the previous year wa s 10000 or less you qualify for a 4000 property tax exemption. Find free access to assistance programs to help you with your bills.

Its designed to help low-income homeowners by ensuring that the property tax is based on the percentage of an individuals income rather than the propertys value. Another option is the formal property tax assistance program which provides qualified elderly California residents with cash reimbursements. Property owners can choose to pay 0 full deferral 25 50 or 75 of the delinquent and future property taxes.

Preferential Property Tax Assessment Program The Georgia Preferential Property Tax Assessment Program for Rehabilitated Historic Property allows eligible participants to apply for an 8 12 -year property tax assessment freeze. Assistance is up to 50000 payable to the Lender Servicer or Payee s with the amount based on program requirements. Make an Estimated Payment in GTC.

Property Tax Returns and Payment. The Georgia Department of Revenue has provided relief as specified in the below FAQs and Press Releases. Check If You Qualify For This Homeowner StimuIus Fast Easy.

Apply for SNAP Reapply for SNAP. Program Overview The State of Georgia received 989 million from US. Our program opens on June 1 and applications must be submitted by Dec.

County Property Tax Facts. Some of these programs have been recently created as a result of the housing crisis and the national recession. If the homeowner does not want to do this work and needs help then hire an attorney property tax consultant or even a realtor.

The applicant must have been using the property as their primary residence for at least one year. Georgia Gateway SNAP The Supplemental Nutrition Assistance Program SNAP also known as food stamps provides monthly funds for families to purchase groceries. Property tax assistance program georgia Friday June 3 2022 You may qualify for Clean Energy Property Tax Credits up to 35 or 100000.

Dont Miss Your Chance. Property owner must be 65 or older. Georgia property tax relief inc.

There are two types of threshold circuit breakers. Check Your Eligibility Today. Please visit IRS - Free Tax Return Preparation for Qualifying Taxpayers for qualification requirements.

This is public data and is at the assessors office or online and by law they need to help show you how to do the research. State Tax Incentives Available are two types of incentives including a state income tax credit equal to 25 percent of the projects Qualified Rehabilitation Expenditures and a property tax freeze for 8 and a half years.

Learn More About Georgia Property Tax H R Block

Georgia Retirement Tax Friendliness Smartasset

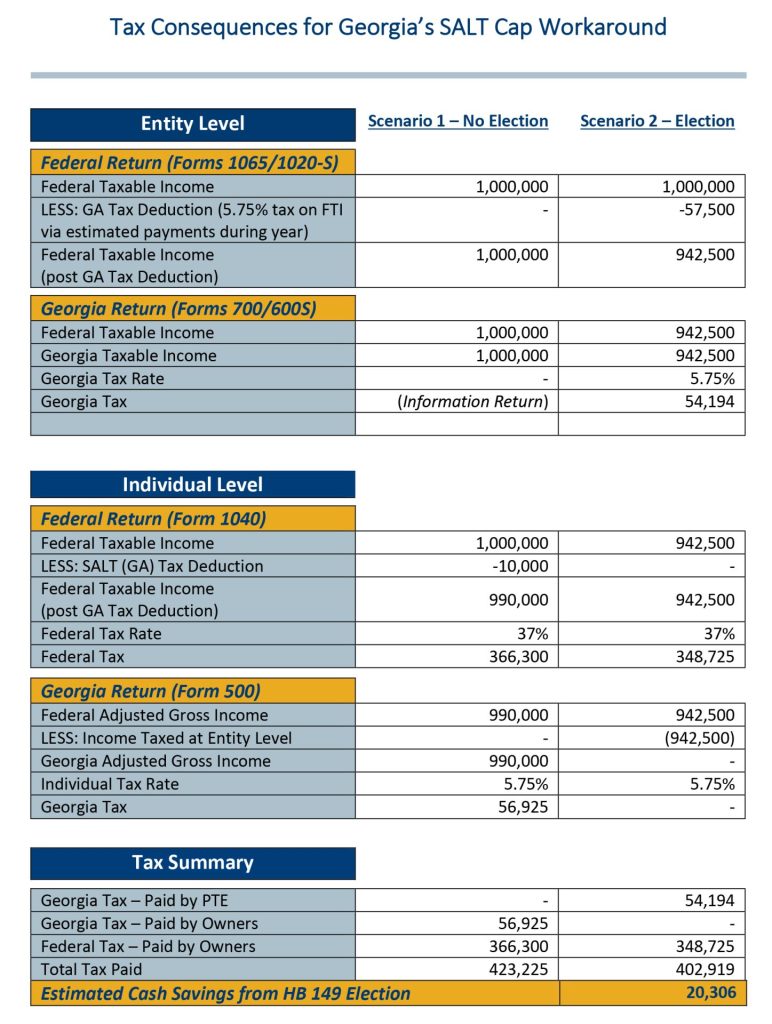

The Benefits Of Georgia S Salt Cap Workaround Bennett Thrasher

Georgia Tax Relief Information Larson Tax Relief

S Corp Taxes Tips Tax Preparation Llc Taxes Sole Proprietorship

5 Property Tax Deductions In Georgia You Should Know Excalibur

2021 Property Tax Bills Sent Out Cobb County Georgia

Home Newton County Tax Commissioner

Tax Commissioner Camden County Ga Official Website

Georgia House Gop Leadership Seeks 1 Billion Income Tax Cut Wabe

2021 Property Tax Bills Sent Out Cobb County Georgia

Georgia Revenue Primer For State Fiscal Year 2022 Georgia Budget And Policy Institute

Georgia State Sales Tax Georgia State Visit Georgia Georgia

Search Pay Property Taxes Online Clayton County Ga

Georgia Revenue Primer For State Fiscal Year 2022 Georgia Budget And Policy Institute

A Guide To Georgia Business Personal Property Taxes

Ecommerce Businesses Can Integrate Shopping Carts Automatically From Walmart Amazon Shopify And Ebay Online Taxes Filing Taxes Sales Tax

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute